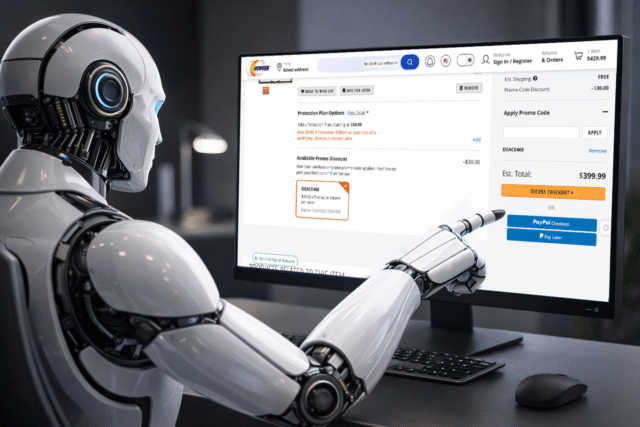

Visa says it has completed hundreds of real-world transactions initiated by AI agents, marking an early test of a (near) future where software can move from shopping recommendations to payment without a human needing to click through the checkout process.

The transactions were carried out with partners across Visa’s payments ecosystem and took place on live systems, rather than in demonstrations or simulations. According to the company, they show that AI-driven purchases can be completed securely using existing payment infrastructure, so long, that is, as the agent operates within predefined controls.

Visa’s research says 47 percent of US consumers now rely on AI tools for at least one shopping-related task, such as comparing prices, finding alternatives, or receiving personalized recommendations.

While these tools stop short of paying for items today, Visa believes that discovery and decision-making are already moving away from traditional search and manual browsing. This is something that OpenAI firmly believes in too.

AI agents handling payment

Once AI systems become properly trusted enough to suggest what to buy, the company feels it is only a small step for them to handle payment as well. In fact, Visa predicts that by the 2026 holiday season, millions of consumers will be using AI agents to complete purchases on their behalf, rather than manually entering payment details or clicking through checkout flows.

That shift would fundamentally change how payment systems work. Instead of responding to a human user at the point of sale, the system would need to recognize and authorize a software agent acting under instructions set by the cardholder, such as spending limits, approved merchants, or product categories.

This effort sits under Visa Intelligent Commerce, an initiative focused on supporting AI-assisted and AI-initiated payments. Visa says the project builds on technology it already uses for fraud detection and transaction monitoring, although the “user” initiating the payment is no longer always a person.

“We are seeing impressive progress in how AI will transform commerce, with many real-world transactions completed by Visa’s deep network of partners,” said Rubail Birwadker, SVP, Head of Growth Products and Partnerships at Visa. “This holiday season marks the end of an era. In 2026, AI agents won’t just assist your shopping — they will complete your purchases, powered by Visa’s global scale, standards leadership, and unparalleled commitment to secure agentic commerce.”

What makes the update most noteworthy is that Visa is moving beyond theory. The company says more than 100 partners are involved globally, with over 30 building tools within its sandbox environment. More than 20 AI agents or agent platforms are integrating directly with Visa Intelligent Commerce, and hundreds of controlled transactions have already taken place in live settings.

In the US, several early pilots are running in closed beta. Some focus on consumer use cases, where AI agents recommend products and then complete purchases through browser-based automation. Others target businesses, where AI handles recurring payments or high-volume transactions while remaining within existing card payment frameworks.

Visa says these pilots show that agent-driven transactions can function end to end, from intent to authorization, without requiring changes to the underlying payment rails.

The company is also preparing to expand its trials internationally. Pilot programs are expected to begin in parts of Asia Pacific and Europe in early 2026. In Latin America and the Caribbean, Visa says it is working with merchants to support AI-initiated purchases over the coming year. In the Middle East, the company is collaborating with partners to enable AI agents to manage routine payments such as recurring service fees.

Security and trust are central concerns. Merchants already deal with large volumes of automated traffic, much of it malicious. Visa says it has introduced a Trusted Agent Protocol with more than 10 partners to help distinguish legitimate AI agents acting on behalf of consumers from unauthorized bots. The protocol is designed to work with existing web infrastructure and support authenticated, agent-driven checkout.

Akamai has joined the initiative, integrating the protocol with its bot detection and behavioral analysis tools to help merchants identify which AI agents are authorized to transact, without opening storefronts to automated abuse.

The bigger question is whether consumers are ready to let software complete purchases on their behalf. While agent-driven checkout could save time and reduce friction, it could also make spending feel less deliberate, especially for people who already struggle with budgeting or impulse buying.

For now, Visa suggests the shift will be a gradual one. Discovery has already moved toward AI-assisted tools. Checkout could be next. If the company’s timeline holds, AI-initiated purchases may not feel unusual by late 2026.

What do you think about AI agents completing purchases for you? Let us know in the comments.