Mainland China’s smartphone market contracted slightly in 2025, with shipments falling 1 percent year on year to 282.3 million units, according to new research from Omdia. Huawei returned to the top position after five years, overtaking rivals in a market that remained highly competitive despite reduced demand.

The Chinese tech giant shipped 46.8 million smartphones over the year, giving it a 17 percent market share. That was enough to secure first place, although the margin over its closest competitors remained narrow throughout the year.

vivo took second with shipments of 46.0 million units, accounting for 16 percent. This kept it within close range of Huawei, showing how tight competition has become at the top.

Apple held onto third place, shipping 45.9 million units across the year. Strong momentum in the final quarter helped prop up its annual total, and allowing it to stay competitive against domestic brands.

Xiaomi took fourth with 43.7 million units and OPPO followed closely in fifth place with shipments of 42.8 million units.

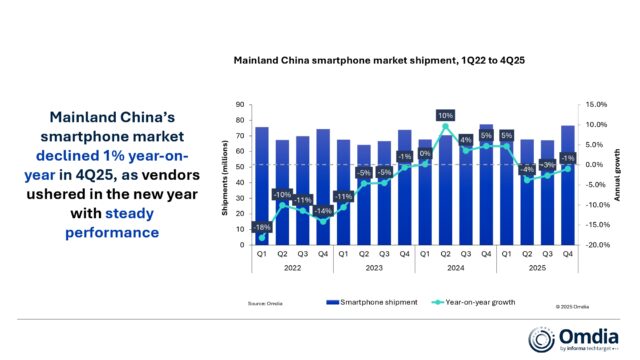

China’s smartphone market decline

In the fourth quarter, the decline slowed with shipments totalling 76.4 million units, just 1 percent lower than a year earlier, helped by end-of-year discounts and ongoing government subsidies.

Apple led the market during this quarter with shipments of 16.5 million units, translating into a 22 percent market share. vivo took second with 11.9 million units, and 16 percent of the market.

OPPO rebounded during the quarter, shipping 11.6 million units and moving up two positions compared with the same period a year earlier. Huawei only managed fourth in the quarter with 11.1 million units shipped, followed closely by Xiaomi at 10.0 million units.

Commenting on Apple’s performance, Hayden Hou, principal analyst at Omdia, said, “Apple achieved solid shipment growth by leveraging a product differentiation and upgrade strategy, supporting overall volumes while refining its portfolio.” He added that “strong consumer reception for the redesigned iPhone 17 Pro series” played a role, while noting that “the iPhone 17 features comprehensive upgrades to storage and display specifications while maintaining the same entry-level pricing as its predecessor.”

Hou also addressed the wider shift among domestic brands, saying, “Local brands are steadily advancing their premiumization strategies.” He noted Huawei’s platform investment, stating that it “has increased its investment in HarmonyOS and carried out a comprehensive upgrade, launching HarmonyOS 6 in October and committing RMB 1 billion to support innovation in the HarmonyOS and AI ecosystem.”

He added that Xiaomi “brought forward the launch of its flagship Xiaomi 17 Ultra to December,” releasing it ahead of competing flagship launches.

Lucas Zhong, analyst at Omdia, said government incentives affected timing rather than overall demand. “The impact of national subsidy policies on the market is mainly reflected in pulling demand forward rather than generating organic growth,” he said, adding that inconsistent subsidies during the middle of the year led to a period of adjustment.

Looking ahead, Hou warned that cost pressures are set to intensify. “In 2026, rising costs will become a major challenge for smartphone vendors in both mainland China and global markets,” he said, pointing specifically to memory pricing and its impact on supply and product planning.

Despite those pressures, Hou said investment plans remain intact. “Vendors are sustaining investments in long-term value drivers,” he said, adding that the market is expected to focus on value growth and product innovation rather than volume expansion.

China’s results contrast with the more positive picture in the global market, where Omdia found the smartphone market returning to growth in the final quarter of the year. Shipments rose 4 percent year on year, led by larger vendors, with Apple taking first place globally ahead of Samsung. Xiaomi, vivo, and OPPO rounded out the top five. The global rebound was helped by seasonal demand and tighter inventory control, although rising component costs continue to create uneven conditions across regions.

What do you think about Huawei reclaiming the top spot in China’s smartphone market? Let us know in the comments.

Image Credit: DepositPhotos