But import taxes could impact longer-term pricing, US console supplies.

A game card being inserted into a Nintendo Switch 2. Credit: Nintendo

Last week, Nintendo made the unprecedented move of delaying US Switch 2 preorders to “assess” the impact of Donald Trump’s massive tariffs on the countries where the console is produced. Before most of those tariffs were recently delayed for 90 days, many were wondering if the company may be mulling a last-minute increase in the Switch 2’s $450 asking price to account for those import taxes.

While industry analysts think that kind of immediate price increase is unlikely, they warn that Trump’s tariffs could have longer-term impacts on Switch 2 pricing and supplies in the US for years to come.

Already baked in

DFC Intelligence CEO David Cole, for instance, said in a recent analyst note that the company is currently modeling “a 20 percent price increase over the next two years” across all video game hardware thanks to “broader macroeconomic challenges.” In the case of the Switch 2, though, Cole clarified that “we believe much of the 20 percent increase was already baked into the $450 price,” which Nintendo is “not likely” to raise at this point.

Other game industry analysts similarly don’t expect Nintendo to announce a price bump so soon after its initial pricing announcement. “I believe it is now too late for Nintendo to drive up the price further, if that ever was an option in the first place,” Kantan Games’ Serkan Toto told GamesIndustry.biz. “As far as tariffs go, Nintendo was looking at a black box all the way until April 2, just like everybody else. As a hardware manufacturer, Nintendo most likely ran simulations to get to a price that would make them tariff-proof as much as possible.”

Nintendo of America President Doug Bowser standing alongside a more familiar Bowser.

Speaking to NPR, though, Nintendo of America president Doug Bowser said the $450 US price for the console was “made based on previous tariffs, and there was no impact from previous tariffs on [that] pricing.” Regarding the tariffs Trump announced last Wednesday—just hours after Nintendo’s own pricing announcement—Bowser said that “much like every other company, I think, in the US right now, we’re in the process of actively assessing what the impact may be.”

In making that assessment, Niko Partners analyst Daniel Ahmad said in a recent note that Nintendo is likely finding that “the reciprocal tariffs on Vietnam and Japan have come in higher than expected, and Nintendo will feel the impact if the tariffs go into full effect. That being said, we think it’s unlikely that Nintendo will raise the price of the console at this point…”

Wedbush Securities Managing Director & Global Head of Technology Research Dan Ives broke with other analysts, though, telling NBC News that Nintendo has “got to figure out what they’re gonna charge. Do they charge 50 percent more? Do they charge double? Do they even ship them?”

But Nintendo may have also been able to delay the financial pain of Trump’s tariffs by getting a significant amount of hardware into the US ahead of implementation. MST Financial analyst David Gibson recently pointed out to the Financial Times that Nintendo shipped an estimated 383,000 Switch 2 units from Vietnam to the US in January alone, and likely “ramped-up [shipments] significantly in February and March.”

The hardest thing to predict is the future

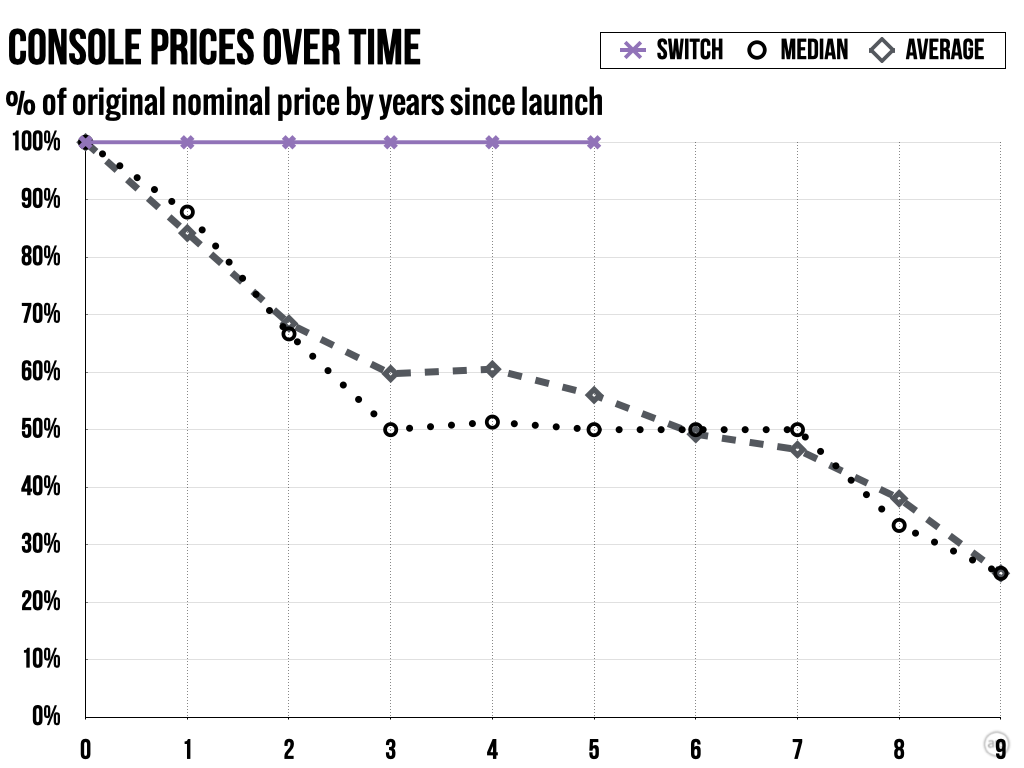

Beyond any immediate price increases, analysts broadly agreed that Trump’s tariffs will make it much harder for Nintendo to drop the Switch 2’s price in the future. DFC Intelligence’s Cole said that “where we model a 20 percent price decrease in the next year or so, we have the prices holding steady” due to tariffs. Niko Partners’ Ahmad similarly said that his firm does “not expect a price drop for the Switch 2 within its first five years, especially given recent reciprocal tariffs and higher component costs.”

Even without tariffs, the price of the original Nintendo Switch remained remarkably stable for years after launch.

Even without tariffs, the price of the original Nintendo Switch remained remarkably stable for years after launch.

Others think the tariffs may actually lead Nintendo to raise hardware prices after the initial launch window. “If the tariffs persist, I think a price increase in 2026 might be on the table,” Ampere Analysis’ Piers Harding-Rolls told Gamespot. “Nintendo will be treading very carefully considering the importance of the US market. It might decide to take a hit on the hardware margin and aim to offset any pressure on profit by building a bigger eShop business and through more in-game monetization.”

While Nintendo could theoretically avoid tariff impacts by moving Switch 2 production into the US, Wedbush’s Ives pointed out that the process would cost “tens of billions of dollars” and require “four to five years” to get a US factory of that scale up and running. Even then, the individual parts to make consoles like the Switch 2 would likely still have to come from countries with tariffs on them.

Niko Partners’ Ahmad pointed out that Nintendo would also “need to find, train, and pay employees to operate [a potential US] factory” and then pay them “10x to 15x more than they would for a worker in Vietnam.” Those are all costs that would mean a US-produced Switch would come in at “a significantly higher price than $450,” Ahmad said.

Early adopters will likely pay any price to get their hands on this thing. Credit: Kyle Orland

Overall, analysts still expect the Switch 2 to sell well early on despite economic and pricing uncertainty. That said, DFC’s Cole allowed that “Nintendo may choose to scale back its manufacturing” due to those concerns, and “if prices increase substantially due to tariffs, a significant portion of prospective buyers are likely to hold back on a purchase until prices come down.”

Cole used those pricing concerns to explain why DFC had lowered its first-year worldwide sales estimates for the Switch 2 from 17 million to 15 million. But Cole also noted that he expects the Switch 2 to be “the fastest-selling console system ever in its first two years” despite that reduced estimate.

Circana analyst Mat Piscatella similarly told IGN that tariffs likely won’t affect “the price insensitive super enthusiasts” who will scoop up “the limited quantities [of Switch 2] that will be available during the launch year.” After that, though, “the true test will come in year two, as supply is likely to become more readily available, and the addressable market will be forced to widen. So we’ll have to see what happens over the next nine to 12 months.”

This story was updated shortly after initial publication April 9, 2025, to note Trump’s 90-day tariff pause.

Kyle Orland has been the Senior Gaming Editor at Ars Technica since 2012, writing primarily about the business, tech, and culture behind video games. He has journalism and computer science degrees from University of Maryland. He once wrote a whole book about Minesweeper.