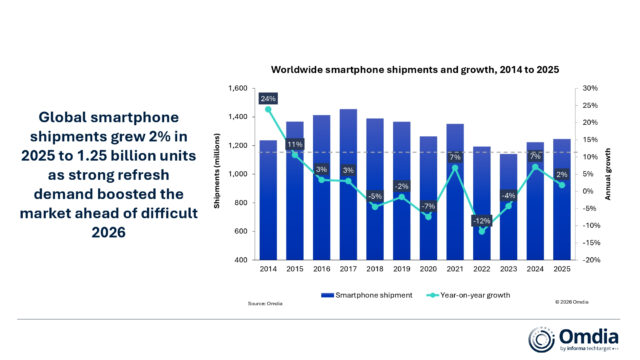

Global smartphone shipments rose by 2 percent in 2025, reaching 1.25 billion units and marking the highest annual total since 2021, according to new research from Omdia. Growth was recorded across all regions except Greater China, where shipments fell slightly as the effects of an earlier national subsidy scheme faded.

Demand from upgraders and replacement buyers supported volumes throughout the year. Several vendors posted record shipment levels despite continued uncertainty in the wider business environment.

The market closed the fourth quarter of 2025 with 4 percent year-on-year growth. Seasonal demand and strong vendor performance supported results late in the year, although rising component and memory costs began to affect expectations for early 2026.

“Although 2025 overall has been a positive year for most vendors, headwinds are building for the 2026 outlook,” said Runar Bjorhovde, senior analyst at Omdia.

Apple delivered its highest annual shipment volume in 2025, with iPhone shipments growing 7 percent to 240.6 million units, helping it keep its title as the world’s largest smartphone vendor for the third consecutive year.

An all-time high fourth quarter supported Apple’s annual result. Shipments in Mainland China rose 26 percent year on year, driven by stronger demand for the iPhone 17 series.

Samsung also rebounded in 2025 after three consecutive years of decline. Its shipments increased 7 percent year on year, finishing marginally behind Apple by the end of the year.

The recovery was driven by a strong fourth quarter, with shipments up 16 percent year on year. Omdia attributed this to resilient flagship demand alongside a recovery in mass-market volumes, including improved performance in entry-level and mainstream segments.

Xiaomi defended its third-place position despite a weaker end to the year. Shipments declined 2 percent as entry-level demand softened and several key markets contracted sharply in the fourth quarter.

Vivo moved into fourth place for the first time, with shipments growing 4 percent to 105.3 million units. Growth was supported by continued strength in India and stable performance in its domestic market.

OPPO completed the top five, shipping 100.7 million units in 2025, down 3 percent from the previous year.

Beyond the top five, several vendors reported continued demand despite challenging conditions which are only going to get worse. Honor and Lenovo grew their shipments by 11 percent and 6 percent respectively. Huawei continued growing and reclaimed the top position in Mainland China for the first time in five years.

Nothing was the fastest-growing vendor of 2025, with shipments rising 86 percent to more than 3 million units.

Global smartphone woes for 2026

According to Omdia’s report titled “DRAM Eats Smartphones: What Matters for Success in 2026,” escalating supply-side pressures in DRAM, NAND, and other semiconductors are expected to squeeze margins, force pricing adjustments, and weaken consumer demand.

Vendors with smaller scale, limited long-term supplier relationships, high LPDDR4 and LPDDR4X exposure, and large low-end portfolios all face much greater risk.

“With market contraction looking increasingly unavoidable for 2026, vendors will shift toward prioritizing profitability while expanding alternative revenue streams,” said Le Xuan Chiew, research manager at Omdia.

“Periods of disruption offer a competitive edge to the vendors, suppliers, and partners who navigate challenges with agility,” Chiew added. “These conditions create a strategic opening to capture upgrade switchers, scale across new channels, and secure the market share vital for long-term resilience. The defining question for 2026 and beyond is which vendors will most effectively acquire customers and optimize partnerships while navigating persistent supply-side pressures.”

What do you think about where the smartphone market is heading next? Let us know in the comments.

Image credit: Im_Yanis/depositphotos.com