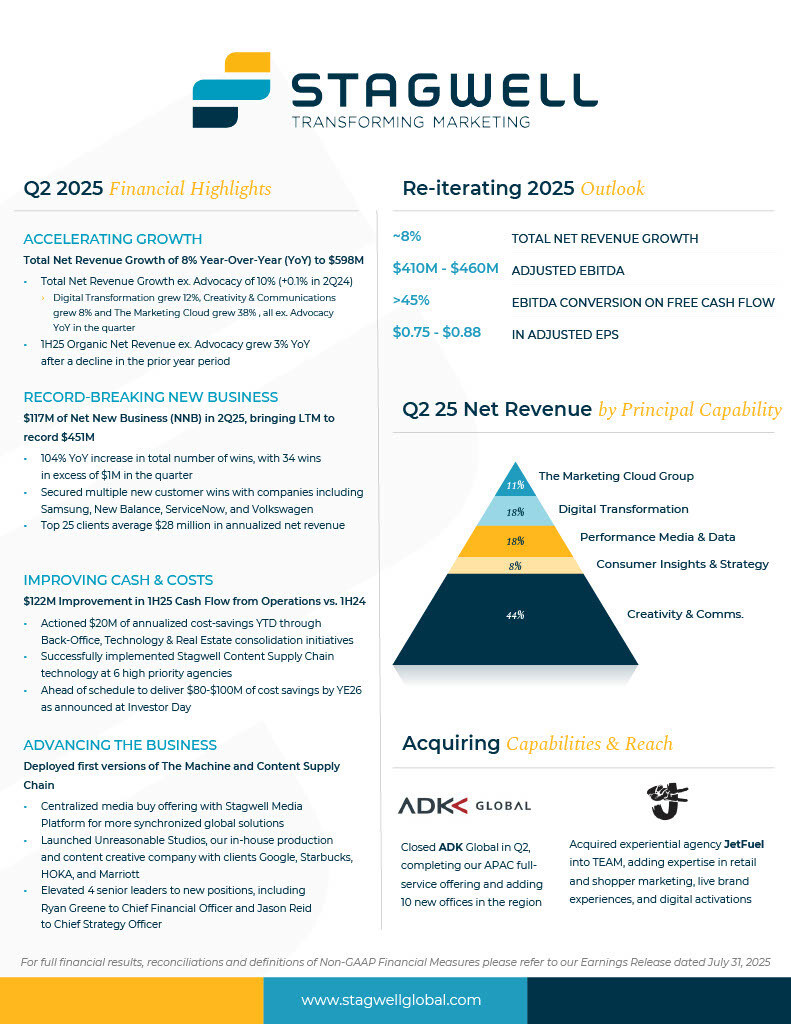

Q2 YoY Revenue Growth of 5%, Q2 YoY Net Revenue Growth of 8%

Q2 YoY Net Revenue Growth excluding Advocacy of 10%, Digital Transformation Net Revenue ex. Advocacy Growth of 12%

Q2 Net Loss Attributable to Stagwell Inc. Common Shareholders of $5 million; Q2 Adjusted EBITDA of $93 million; Q2 Adjusted EBITDA ex. Advocacy YoY Growth of 23% to $80 million

Q2 EPS of $(0.02); Adjusted EPS of $0.17

YTD Increase in Cash Flow from Operations of $122 million Over Prior Year Period

Net New Business of $117 million in Q2; LTM Net New Business of $451 million

Reiterate Guidance for 2025 of Total Net Revenue Growth of ~8%; Adjusted EBITDA of $410 million to $460 million; Free Cash Flow Conversion in excess of 45%

, /PRNewswire/ — (NASDAQ: STGW) – Stagwell Inc. (“Stagwell”) today announced financial results for the three and six months ended June 30, 2025.

SECOND QUARTER RESULTS:

- Q2 Revenue of $707 million, an increase of 5% versus the prior year period; YTD Revenue of $1,359 million, an increase of 1% versus the prior year period;

- Q2 Revenue ex. Advocacy of $651 million, an increase of 9% versus the prior year period; YTD Revenue ex. Advocacy of $1,261 million, an increase of 5% versus the prior year period;

- Q2 Net Revenue of $598 million, an increase of 8% versus the prior year period; YTD Net Revenue of $1,162 million, an increase of 7% versus the prior year period;

- Q2 Net Revenue ex. Advocacy of $560 million, an increase of 10% versus the prior year period; YTD Net Revenue of $1,095 million, an increase of 10% versus the prior year period;

- Q2 Net Loss attributable to Stagwell Inc. Common Shareholders of $5 million versus $3 million in the prior year period; YTD Net Loss attributable to Stagwell Inc. Common Shareholders of $8 million versus $4 million in the prior year period;

- Q2 Adjusted EBITDA of $93 million, an increase of 8% versus the prior year period; YTD Adjusted EBITDA of $173 million, a decrease of 2% versus the prior year period;

- Q2 Adjusted EBITDA Margin of 16% on net revenue; YTD Adjusted EBITDA Margin of 15% on net revenue;

- Q2 Earnings Per Share Attributable to Stagwell Inc. Common Shareholders of $(0.02) versus $(0.03) in the prior year period; YTD Earnings Per Share Attributable to Stagwell Inc. Common Shareholders of $(0.06) versus $(0.04) in the prior year period;

- Q2 Adjusted Earnings Per Share attributable to Stagwell Inc. Common Shareholders of $0.17 versus $0.14 in the prior year period; YTD Adjusted Earnings Per Share attributable to Stagwell Inc. Common Shareholders of $0.29 versus $0.30 in the prior year period;

- YTD Net Cash provided by Operating Activities of $55 million versus net cash used in Operating Activities of $68 million in the prior year period;

- Net new business of $117 million in the second quarter, last twelve-month net new business of $451 million

See “Non-GAAP Financial Measures” below for explanations and reconciliations of the Company’s non-GAAP financial measures.

Mark Penn, Chairman and CEO of Stagwell, said, “With 10% ex advocacy net revenue growth, Stagwell is taking share and building momentum across all key metrics this quarter. In Q2, we posted net new business of $117 million, strong performance at our Digital Transformation businesses, 26% growth among our Top 25 customers, and our first major Government win. Stagwell’s differentiated approach is resonating.”

Ryan Greene, Chief Financial Officer, commented: “I am proud to take on the role of Chief Financial Officer at Stagwell. The second quarter has seen us deliver strong results, hitting $93 million in Adjusted EBITDA, which includes a 23% increase in ex-advocacy EBITDA. Importantly, we have made significant progress on two key initiatives: improving our year-to-date cash flow from operations by $122 million versus the same period last year, and taking actions amounting to $20 million in annualized cost savings, putting us firmly ahead of schedule to deliver the $80 to $100 million in cost savings by the end of 2026 that we promised at our Investor Day in April.”

Financial Outlook

2025 financial guidance is reiterated as follows:

- Total Net Revenue growth of approximately 8%

- Adjusted EBITDA of $410 million to $460 million

- Free Cash Flow Conversion in excess of 45%

- Adjusted EPS of $0.75 – $0.88

- Guidance includes anticipated impact from acquisitions or dispositions.

* The Company has excluded a quantitative reconciliation with respect to the Company’s 2025 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See “Non-GAAP Financial Measures” below for additional information.

Video Webcast

Management will host a video webcast on Thursday, July 31, 2025, at 8:30 a.m. (ET) to discuss results for Stagwell Inc. for the three and six months ended June 30, 2025. The video webcast will be accessible at https://edge.media-server.com/mmc/p/fwa9mu68/. An investor presentation has been posted on our website at www.stagwellglobal.com and may be referred to during the webcast.

A recording of the webcast will be accessible one hour after the webcast and available for ninety days at www.stagwellglobal.com.

Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contacts

For Investors:

Ben Allanson

[email protected]

For Press:

Beth Sidhu

[email protected]

Non-GAAP Financial Measures

In addition to its reported results, Stagwell Inc. has included in this earnings release certain financial results that the Securities and Exchange Commission (SEC) defines as “non-GAAP Financial Measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company’s results. Such non-GAAP financial measures include the following:

(1) Organic Net Revenue: “Organic net revenue growth” and “Organic net revenue decline” reflects the year-over-year change in the Company’s reported net revenue attributable to the Company’s management of the entities it owns. We calculate organic net revenue growth (decline) by subtracting the net impact of acquisitions (divestitures) and the impact of foreign currency exchange fluctuations from the aggregate year-over-year increase or decrease in the Company’s reported net revenue. The net impact of acquisitions (divestitures) reflects the year-over-year change in the Company’s reported net revenue attributable to the impact of all individual entities that were acquired or divested in the current and prior year. We calculate impact of an acquisition as follows: (a) for an entity acquired during the current year, we present the entity’s prior year net revenue for the same period during which we owned it in the current year as impact of the acquisition in the current year; and (b) for an entity acquired in the prior year, we present the entity’s prior year net revenue for the period during which we did not own the entity in the prior year as impact of the acquisition in the current year. We calculate impact of a divestiture as follows: (a) for a divestiture in the current year, we present the entity’s prior year net revenue for the same period during which we no longer owned it in the current year as impact of the divestiture in the current year; and (b) for a divestiture in the prior year, we present the entity’s prior year net revenue for the period during which we owned it in the prior year as impact of the divestiture in the current year. We calculate the impact of any acquisition or divestiture without adjusting for foreign currency exchange fluctuations. The impact of foreign currency exchange fluctuations reflects the year-over-year change in the Company’s reported net revenue attributable to changes in foreign currency exchange rates. We calculate the impact of foreign currency exchange fluctuations for the portion of the reporting period in which we recognized revenue from a foreign entity in both the current year and the prior year. The impact is calculated as the difference between (1) reported prior period net revenue (converted to U.S. dollars at historical foreign currency exchange rates) and (2) prior period net revenue converted to U.S. dollars at current period foreign exchange rates.

(2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period.

(3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items.

(4) Adjusted Diluted EPS is defined as (i) Net income (loss) attributable to Stagwell Inc. common shareholders, plus net income attributable to Class C shareholders, excluding amortization expense, impairment and other losses, stock-based compensation, deferred acquisition consideration adjustments, discrete tax items, and other items, divided by (ii) (a) the per weighted average number of common shares outstanding plus (b) the weighted average number of Class C shares outstanding, (if dilutive). Other items includes restructuring costs, acquisition-related expenses, and non-recurring items, and subject to the anti-dilution rules.

(5) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments. Free Cash Flow Conversion is the percentage of adjusted EBITDA.

Included in this earnings release are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company’s representatives may also make forward-looking statements orally or in writing from time to time. Statements in this document that are not historical facts, including, statements about the Company’s beliefs and expectations, future financial performance, growth, and future prospects, the Company’s strategy, business and economic trends and growth, technological leadership and differentiation, potential and completed acquisitions, anticipated and actual operating efficiencies and synergies and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Forward-looking statements, which are generally denoted by words such as “ability,” “aim,” “anticipate,” “assume,” “believe,” “build,” “consider,” “continue,” “could,” “develop,” “drive,” “estimate,” “expect,” “focus,” “forecast,” “future,” “guidance,” “intend,” “likely,” “maintain,” “may,” “ongoing,”, “outlook,” “plan,” “possible,” “potential,” “probable,” “project,” “seek,” “should,” “target,” “will,” “would” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, estimates and projections are subject to change based on a number of factors, including those outlined in this section.

Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company. Although the management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The material assumptions upon which such forward-looking statements are based include, among others, assumptions with respect to general business, economic and market conditions, the competitive environment, anticipated and unanticipated tax consequences and anticipated and unanticipated costs. These forward-looking statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any.

Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following:

- risks associated with international, national and regional unfavorable economic conditions, including the effect of changing tariff and other trade policies, inflation and other macroeconomic factors that could affect the Company or its clients;

- demand for the Company’s services, which may precipitate or exacerbate other risks and uncertainties;

- inflation and actions taken by central banks to counter inflation;

- the Company’s ability to attract new clients and retain existing clients;

- the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

- financial failure of the Company’s clients;

- the Company’s ability to retain and attract key employees;

- the Company’s ability to compete in the markets in which it operates;

- the Company’s ability to achieve its cost saving initiatives;

- the Company’s implementation of strategic initiatives;

- the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration;

- the Company’s ability to manage its growth effectively;

- the Company’s ability to identify and complete acquisitions or other strategic transactions that complement and expand the Company’s business capabilities and successfully integrate newly acquired businesses into the Company’s operations, retain key employees, and realize cost savings, synergies and other related anticipated benefits within the expected time period;

- the Company’s ability to identify and complete divestitures and to achieve the anticipated benefits therefrom;

- the Company’s ability to develop products incorporating new technologies, including augmented reality, artificial intelligence, and virtual reality, and realize benefits from such products;

- the Company’s use of artificial intelligence, including generative artificial intelligence;

- adverse tax consequences for the Company, its operations and its stockholders, that may differ from the expectations of the Company, including that recent or future changes in tax laws, potential changes to corporate tax rates in the United States and disagreements with tax authorities on the Company’s determinations that may result in increased tax costs;

- adverse tax consequences in connection with the business combination that formed the Company in August 2021, including the incurrence of material Canadian federal income tax (including material “emigration tax”);

- the Company’s ability to maintain an effective system of internal control over financial reporting, including the risk that the Company’s internal controls will fail to detect misstatements in its financial statements;

- the Company’s ability to accurately forecast its future financial performance and provide accurate guidance;

- the Company’s ability to protect client data from security incidents or cyberattacks;

- economic disruptions resulting from war and other economic and geopolitical tensions (such as the ongoing military conflicts between Russia and Ukraine and in the Middle East), terrorist activities, natural disasters, public health events and tariff and trade policies;

- stock price volatility; and

- foreign currency fluctuations.

Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2024 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 11, 2025, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

|

SCHEDULE 1 |

||||||||||||||

|

STAGWELL INC. |

||||||||||||||

|

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS |

||||||||||||||

|

(amounts in thousands, except per share amounts) |

||||||||||||||

|

Three Months Ended |

Six Months Ended |

|||||||||||||

|

2025 |

2024 |

2025 |

2024 |

|||||||||||

|

Revenue |

$ 706,818 |

$ 671,168 |

$ 1,358,558 |

$ 1,341,227 |

||||||||||

|

Operating Expenses |

||||||||||||||

|

Cost of services |

459,216 |

438,912 |

871,303 |

883,438 |

||||||||||

|

Office and general expenses |

183,061 |

168,133 |

362,423 |

331,476 |

||||||||||

|

Depreciation and amortization |

41,369 |

42,001 |

83,375 |

76,837 |

||||||||||

|

Impairment and other losses |

— |

215 |

— |

1,715 |

||||||||||

|

683,646 |

649,261 |

1,317,101 |

1,293,466 |

|||||||||||

|

Operating Income |

23,172 |

21,907 |

41,457 |

47,761 |

||||||||||

|

Other income (expenses): |

||||||||||||||

|

Interest expense, net |

(23,455) |

(23,533) |

(46,811) |

(44,498) |

||||||||||

|

Foreign exchange, net |

(1,338) |

(1,355) |

(118) |

(3,613) |

||||||||||

|

Other, net |

(360) |

193 |

(111) |

(1,074) |

||||||||||

|

(25,153) |

(24,695) |

(47,040) |

(49,185) |

|||||||||||

|

Loss before income taxes and equity in earnings of non-consolidated affiliates |

(1,981) |

(2,788) |

(5,583) |

(1,424) |

||||||||||

|

Income tax expense |

2,673 |

1,165 |

4,395 |

3,750 |

||||||||||

|

Loss before equity in earnings of non-consolidated affiliates |

(4,654) |

(3,953) |

(9,978) |

(5,174) |

||||||||||

|

Equity in income (loss) of non-consolidated affiliates |

20 |

(1) |

19 |

507 |

||||||||||

|

Net loss |

(4,634) |

(3,954) |

(9,959) |

(4,667) |

||||||||||

|

Net (income) loss attributable to noncontrolling and redeemable noncontrolling interests |

(627) |

989 |

1,781 |

420 |

||||||||||

|

Net loss attributable to Stagwell Inc. common shareholders |

$ (5,261) |

$ (2,965) |

$ (8,178) |

$ (4,247) |

||||||||||

|

Loss Per Common Share: |

||||||||||||||

|

Basic |

$ (0.02) |

$ (0.03) |

$ (0.04) |

$ (0.04) |

||||||||||

|

Diluted |

$ (0.02) |

$ (0.03) |

$ (0.06) |

$ (0.04) |

||||||||||

|

Weighted Average Number of Common Shares Outstanding: |

||||||||||||||

|

Basic |

260,774 |

113,484 |

186,843 |

113,059 |

||||||||||

|

Diluted |

260,774 |

113,484 |

265,600 |

113,059 |

||||||||||

|

SCHEDULE 2 |

||||||||||||||||||||||||||||||

|

STAGWELL INC. |

||||||||||||||||||||||||||||||

|

UNAUDITED COMPONENTS OF NET REVENUE CHANGE |

||||||||||||||||||||||||||||||

|

(amounts in thousands) |

||||||||||||||||||||||||||||||

|

Net Revenue – Components of Change |

Change |

|||||||||||||||||||||||||||||

|

Three Months |

Foreign |

Net |

Organic (1) |

Total Change |

Three |

Organic |

Total |

|||||||||||||||||||||||

|

Integrated Agencies Network |

$ 321,870 |

$ 744 |

$ 9,037 |

$ 13,237 |

$ 23,018 |

$ 344,888 |

4.1 % |

7.2 % |

||||||||||||||||||||||

|

Brand Performance Network |

157,108 |

2,289 |

142 |

(4,671) |

(2,240) |

154,868 |

(3.0) % |

(1.4) % |

||||||||||||||||||||||

|

Communications Network |

72,393 |

144 |

10,855 |

(9,050) |

1,949 |

74,342 |

(12.5) % |

2.7 % |

||||||||||||||||||||||

|

All Other |

3,021 |

74 |

17,118 |

3,818 |

21,010 |

24,031 |

126.4 % |

695.5 % |

||||||||||||||||||||||

|

$ 554,392 |

$ 3,251 |

$ 37,152 |

$ 3,334 |

$ 43,737 |

$ 598,129 |

0.6 % |

7.9 % |

|||||||||||||||||||||||

|

(1) |

See Non-GAAP Financial Measures section above for the definition of Organic Net Revenue. |

|

SCHEDULE 3 |

||||||||||||||||||||||||||||||

|

STAGWELL INC. |

||||||||||||||||||||||||||||||

|

UNAUDITED COMPONENTS OF NET REVENUE CHANGE |

||||||||||||||||||||||||||||||

|

(amounts in thousands) |

||||||||||||||||||||||||||||||

|

Net Revenue – Components of Change |

Change |

|||||||||||||||||||||||||||||

|

Six Months |

Foreign |

Net |

Organic (1) |

Total Change |

Six Months |

Organic |

Total |

|||||||||||||||||||||||

|

Integrated Agencies Network |

$ 614,642 |

$ (198) |

$ 13,580 |

$ 42,658 |

$ 56,040 |

$ 670,682 |

6.9 % |

9.1 % |

||||||||||||||||||||||

|

Brand Performance Network |

319,670 |

1,011 |

142 |

(19,097) |

(17,944) |

301,726 |

(6.0) % |

(5.6) % |

||||||||||||||||||||||

|

Communications Network |

139,881 |

101 |

25,203 |

(23,845) |

1,459 |

141,340 |

(17.0) % |

1.0 % |

||||||||||||||||||||||

|

All Other |

12,653 |

(80) |

29,764 |

6,231 |

35,915 |

48,568 |

49.2 % |

283.8 % |

||||||||||||||||||||||

|

$ 1,086,846 |

$ 834 |

$ 68,689 |

$ 5,947 |

$ 75,470 |

$ 1,162,316 |

0.5 % |

6.9 % |

|||||||||||||||||||||||

|

(1) |

See Non-GAAP Financial Measures section above for the definition of Organic Net Revenue. |

|

SCHEDULE 4 |

||||||||||||||||||||||

|

STAGWELL INC. |

||||||||||||||||||||||

|

UNAUDITED SEGMENT OPERATING RESULTS |

||||||||||||||||||||||

|

(amounts in thousands) |

||||||||||||||||||||||

|

For the Three Months Ended June 30, 2025 |

||||||||||||||||||||||

|

Integrated |

Brand |

Communications |

All Other |

Corporate |

Total |

|||||||||||||||||

|

Net Revenue |

$ 344,888 |

$ 154,868 |

$ 74,342 |

$ 24,031 |

$ — |

$ 598,129 |

||||||||||||||||

|

Billable costs |

61,302 |

15,231 |

31,786 |

370 |

— |

108,689 |

||||||||||||||||

|

Revenue |

406,190 |

170,099 |

106,128 |

24,401 |

— |

706,818 |

||||||||||||||||

|

Billable costs |

61,302 |

15,231 |

31,786 |

370 |

— |

108,689 |

||||||||||||||||

|

Staff costs |

205,975 |

100,260 |

44,812 |

17,245 |

12,978 |

381,270 |

||||||||||||||||

|

Administrative costs |

34,094 |

25,584 |

9,550 |

6,978 |

(332) |

75,874 |

||||||||||||||||

|

Unbillable and other costs, net |

27,309 |

13,443 |

625 |

6,753 |

— |

48,130 |

||||||||||||||||

|

Adjusted EBITDA (1) |

77,510 |

15,581 |

19,355 |

(6,945) |

(12,646) |

92,855 |

||||||||||||||||

|

Stock-based compensation |

12,288 |

809 |

739 |

167 |

5,951 |

19,954 |

||||||||||||||||

|

Depreciation and amortization |

20,102 |

8,145 |

4,972 |

4,927 |

3,223 |

41,369 |

||||||||||||||||

|

Deferred acquisition consideration |

(4,292) |

2,812 |

(2,376) |

636 |

— |

(3,220) |

||||||||||||||||

|

Other items, net (1) |

3,311 |

3,713 |

1,539 |

1,270 |

1,747 |

11,580 |

||||||||||||||||

|

Operating income (loss) |

$ 46,101 |

$ 102 |

$ 14,481 |

$ (13,945) |

$ (23,567) |

$ 23,172 |

||||||||||||||||

|

(1) |

See Non-GAAP Financial Measures section above for the definition of Adjusted EBITDA and Other items, net. |

|

SCHEDULE 5 |

||||||||||||||||||||||

|

STAGWELL INC. |

||||||||||||||||||||||

|

UNAUDITED SEGMENT OPERATING RESULTS |

||||||||||||||||||||||

|

(amounts in thousands) |

||||||||||||||||||||||

|

For the Six Months Ended June 30, 2025 |

||||||||||||||||||||||

|

Integrated |

Brand |

Communications |

All Other |

Corporate |

Total |

|||||||||||||||||

|

Net Revenue |

$ 670,682 |

$ 301,726 |

$ 141,340 |

$ 48,568 |

$ — |

$ 1,162,316 |

||||||||||||||||

|

Billable costs |

112,862 |

30,591 |

52,416 |

373 |

— |

196,242 |

||||||||||||||||

|

Revenue |

783,544 |

332,317 |

193,756 |

48,941 |

— |

1,358,558 |

||||||||||||||||

|

Billable costs |

112,862 |

30,591 |

52,416 |

373 |

— |

196,242 |

||||||||||||||||

|

Staff costs |

405,857 |

196,710 |

89,389 |

32,700 |

24,876 |

749,532 |

||||||||||||||||

|

Administrative costs |

65,738 |

48,991 |

19,724 |

15,203 |

1,327 |

150,983 |

||||||||||||||||

|

Unbillable and other costs, net |

44,408 |

28,901 |

1,115 |

13,940 |

— |

88,364 |

||||||||||||||||

|

Adjusted EBITDA (1) |

154,679 |

27,124 |

31,112 |

(13,275) |

(26,203) |

173,437 |

||||||||||||||||

|

Stock-based compensation |

16,433 |

2,177 |

1,432 |

396 |

11,059 |

31,497 |

||||||||||||||||

|

Depreciation and amortization |

41,466 |

15,867 |

10,147 |

9,228 |

6,667 |

83,375 |

||||||||||||||||

|

Deferred acquisition consideration |

1,571 |

1,530 |

(1,163) |

1,499 |

— |

3,437 |

||||||||||||||||

|

Other items, net (1) |

1,065 |

7,367 |

1,667 |

1,581 |

1,991 |

13,671 |

||||||||||||||||

|

Operating income (loss) |

$ 94,144 |

$ 183 |

$ 19,029 |

$ (25,979) |

$ (45,920) |

$ 41,457 |

||||||||||||||||

|

(1) |

See Non-GAAP Financial Measures section above for the definition of Adjusted EBITDA and Other items, net. |

|

SCHEDULE 6 |

||||||||||||||||||||||

|

STAGWELL INC. |

||||||||||||||||||||||

|

UNAUDITED SEGMENT OPERATING RESULTS |

||||||||||||||||||||||

|

(amounts in thousands) |

||||||||||||||||||||||

|

For the Three Months Ended June 30, 2024 |

||||||||||||||||||||||

|

Integrated |

Brand |

Communications |

All Other |

Corporate |

Total |

|||||||||||||||||

|

Net Revenue |

$ 321,870 |

$ 157,108 |

$ 72,393 |

$ 3,021 |

$ — |

$ 554,392 |

||||||||||||||||

|

Billable costs |

63,263 |

20,137 |

33,177 |

199 |

— |

116,776 |

||||||||||||||||

|

Revenue |

385,133 |

177,245 |

105,570 |

3,220 |

— |

671,168 |

||||||||||||||||

|

Billable costs |

63,263 |

20,137 |

33,177 |

199 |

— |

116,776 |

||||||||||||||||

|

Staff costs |

195,193 |

99,264 |

41,131 |

7,607 |

12,154 |

355,349 |

||||||||||||||||

|

Administrative costs |

33,902 |

24,525 |

8,379 |

(3,740) |

6,468 |

69,534 |

||||||||||||||||

|

Unbillable and other costs, net |

24,780 |

15,613 |

710 |

2,303 |

— |

43,406 |

||||||||||||||||

|

Adjusted EBITDA (1) |

67,995 |

17,706 |

22,173 |

(3,149) |

(18,622) |

86,103 |

||||||||||||||||

|

Stock-based compensation |

4,849 |

1,445 |

827 |

252 |

(1,498) |

5,875 |

||||||||||||||||

|

Depreciation and amortization |

19,472 |

11,715 |

3,090 |

4,944 |

2,780 |

42,001 |

||||||||||||||||

|

Deferred acquisition consideration |

2,531 |

1,272 |

3,433 |

— |

— |

7,236 |

||||||||||||||||

|

Impairment and other losses |

— |

— |

— |

— |

215 |

215 |

||||||||||||||||

|

Other items, net (1) |

4,029 |

3,268 |

390 |

430 |

752 |

8,869 |

||||||||||||||||

|

Operating income (loss) |

$ 37,114 |

$ 6 |

$ 14,433 |

$ (8,775) |

$ (20,871) |

$ 21,907 |

||||||||||||||||

|

(1) |

See Non-GAAP Financial Measures section above for the definition of Adjusted EBITDA and Other items. |

|

SCHEDULE 7 |

||||||||||||||||||||||

|

STAGWELL INC. |

||||||||||||||||||||||

|

UNAUDITED SEGMENT OPERATING RESULTS |

||||||||||||||||||||||

|

(amounts in thousands) |

||||||||||||||||||||||

|

For the Six Months Ended June 30, 2024 |

||||||||||||||||||||||

|

Integrated |

Brand |

Communications |

All Other |

Corporate |

Total |

|||||||||||||||||

|

Net Revenue |

$ 614,642 |

$ 319,670 |

$ 139,881 |

$ 12,653 |

$ — |

$ 1,086,846 |

||||||||||||||||

|

Billable costs |

123,210 |

71,537 |

59,435 |

199 |

— |

254,381 |

||||||||||||||||

|

Revenue |

737,852 |

391,207 |

199,316 |

12,852 |

— |

1,341,227 |

||||||||||||||||

|

Billable costs |

123,210 |

71,537 |

59,435 |

199 |

— |

254,381 |

||||||||||||||||

|

Staff costs |

381,727 |

197,695 |

80,395 |

15,428 |

22,261 |

697,506 |

||||||||||||||||

|

Administrative costs |

64,504 |

46,596 |

17,083 |

(531) |

9,045 |

136,697 |

||||||||||||||||

|

Unbillable and other costs, net |

40,308 |

30,179 |

846 |

4,891 |

— |

76,224 |

||||||||||||||||

|

Adjusted EBITDA (1) |

128,103 |

45,200 |

41,557 |

(7,135) |

(31,306) |

176,419 |

||||||||||||||||

|

Stock-based compensation |

14,170 |

3,488 |

1,876 |

350 |

2,107 |

21,991 |

||||||||||||||||

|

Depreciation and amortization |

38,853 |

19,229 |

5,984 |

7,365 |

5,406 |

76,837 |

||||||||||||||||

|

Deferred acquisition consideration |

4,576 |

495 |

2,319 |

— |

— |

7,390 |

||||||||||||||||

|

Impairment and other losses |

1,500 |

— |

— |

— |

215 |

1,715 |

||||||||||||||||

|

Other items, net (1) |

9,540 |

8,287 |

672 |

604 |

1,622 |

20,725 |

||||||||||||||||

|

Operating income (loss) |

$ 59,464 |

$ 13,701 |

$ 30,706 |

$ (15,454) |

$ (40,656) |

$ 47,761 |

||||||||||||||||

|

(1) |

See Non-GAAP Financial Measures section above for the definition of Adjusted EBITDA and Other items, net. |

|

SCHEDULE 8 |

||||||||||||

|

STAGWELL INC. |

||||||||||||

|

UNAUDITED RECONCILIATION OF ADJUSTED DILUTED EARNINGS PER SHARE (NON-GAAP MEASURE) |

||||||||||||

|

(amounts in thousands, except per share amounts) |

||||||||||||

|

For the Three Months Ended June 30, 2025 |

||||||||||||

|

GAAP |

Adjustments |

Non-GAAP |

||||||||||

|

Net income (loss) attributable to Stagwell Inc. common shareholders and adjusted net income |

$ (5,261) |

$ 50,331 |

$ 45,070 |

|||||||||

|

Weighted average number of shares outstanding |

260,774 |

7,550 |

268,324 |

|||||||||

|

Diluted EPS and Adjusted Diluted EPS (1) |

$ (0.02) |

$ 0.17 |

||||||||||

|

Adjustments to Net income |

||||||||||||

|

Amortization |

$ 35,593 |

|||||||||||

|

Stock-based compensation |

19,954 |

|||||||||||

|

Deferred acquisition consideration |

(3,220) |

|||||||||||

|

Other items, net |

11,580 |

|||||||||||

|

63,907 |

||||||||||||

|

Adjusted tax expense |

(13,576) |

|||||||||||

|

$ 50,331 |

||||||||||||

|

(1) |

See Non-GAAP Financial Measures section above for the definition of Adjusted Diluted EPS. |

|

SCHEDULE 9 |

||||||||||||

|

STAGWELL INC. |

||||||||||||

|

UNAUDITED RECONCILIATION OF ADJUSTED DILUTED EARNINGS PER SHARE (NON-GAAP MEASURE) |

||||||||||||

|

(amounts in thousands, except per share amounts) |

||||||||||||

|

For the Six Months Ended June 30, 2025 |

||||||||||||

|

GAAP |

Adjustments |

Non-GAAP |

||||||||||

|

Net income (loss) attributable to Stagwell Inc. common shareholders |

$ (8,178) |

$ 93,283 |

$ 85,105 |

|||||||||

|

Net loss attributable to Class C shareholders |

(6,637) |

— |

(6,637) |

|||||||||

|

Net income (loss) attributable to Stagwell Inc. and Class C shareholders and adjusted net income |

$ (14,815) |

$ 93,283 |

$ 78,468 |

|||||||||

|

Weighted average number of common shares outstanding |

186,843 |

8,506 |

195,349 |

|||||||||

|

Weighted average number of shares of Class C Common Stock outstanding |

78,757 |

— |

78,757 |

|||||||||

|

Weighted average number of shares outstanding |

265,600 |

8,506 |

274,106 |

|||||||||

|

Diluted EPS and Adjusted Diluted EPS (1) |

$ (0.06) |

$ 0.29 |

||||||||||

|

Adjustments to Net Income (loss) |

||||||||||||

|

Amortization |

$ 68,574 |

|||||||||||

|

Stock-based compensation |

31,497 |

|||||||||||

|

Deferred acquisition consideration |

3,437 |

|||||||||||

|

Other items, net |

13,671 |

|||||||||||

|

117,179 |

||||||||||||

|

Adjusted tax expense |

(23,896) |

|||||||||||

|

$ 93,283 |

||||||||||||

|

(1) |

See Non-GAAP Financial Measures section above for the definition of Adjusted Diluted EPS. |

|

SCHEDULE 10 |

||||||||||||

|

STAGWELL INC. |

||||||||||||

|

UNAUDITED RECONCILIATION OF ADJUSTED DILUTED EARNINGS PER SHARE (NON-GAAP MEASURE) |

||||||||||||

|

(amounts in thousands, except per share amounts) |

||||||||||||

|

For the Three Months Ended June 30, 2024 |

||||||||||||

|

GAAP |

Adjustments |

Non-GAAP |

||||||||||

|

Net income (loss) attributable to Stagwell Inc. common shareholders |

$ (2,965) |

$ 18,935 |

$ 15,970 |

|||||||||

|

Net income attributable to Class C shareholders |

— |

22,828 |

22,828 |

|||||||||

|

Net income (loss) attributable to Stagwell Inc. and Class C and adjusted net income |

$ (2,965) |

$ 41,763 |

$ 38,798 |

|||||||||

|

Weighted average number of common shares outstanding |

113,484 |

5,281 |

118,765 |

|||||||||

|

Weighted average number of shares of Class C Common Stock outstanding |

— |

151,649 |

151,649 |

|||||||||

|

Weighted average number of shares outstanding |

113,484 |

156,930 |

270,414 |

|||||||||

|

Diluted EPS and Adjusted Diluted EPS (1) |

$ (0.03) |

$ 0.14 |

||||||||||

|

Adjustments to Net income (loss) |

||||||||||||

|

Amortization |

$ 35,008 |

|||||||||||

|

Impairment and other losses |

215 |

|||||||||||

|

Stock-based compensation |

5,875 |

|||||||||||

|

Deferred acquisition consideration |

7,236 |

|||||||||||

|

Other items, net |

8,869 |

|||||||||||

|

57,203 |

||||||||||||

|

Adjusted tax expense |

(12,905) |

|||||||||||

|

44,298 |

||||||||||||

|

Net loss attributable to Class C shareholders |

(2,535) |

|||||||||||

|

$ 41,763 |

||||||||||||

|

Allocation of adjustments to Net income (loss) |

||||||||||||

|

Net income attributable to Stagwell Inc. common shareholders |

$ 18,935 |

|||||||||||

|

Net income attributable to Class C shareholders |

25,363 |

|||||||||||

|

Net loss attributable to Class C shareholders |

(2,535) |

|||||||||||

|

22,828 |

||||||||||||

|

$ 41,763 |

||||||||||||

|

(1) |

See Non-GAAP Financial Measures section above for the definition of Adjusted Diluted EPS. |

|

SCHEDULE 11 |

||||||||||||

|

STAGWELL INC. |

||||||||||||

|

UNAUDITED RECONCILIATION OF ADJUSTED DILUTED EARNINGS PER SHARE (NON-GAAP MEASURE) |

||||||||||||

|

(amounts in thousands, except per share amounts) |

||||||||||||

|

For the Six Months Ended June 30, 2024 |

||||||||||||

|

GAAP |

Adjustments |

Non-GAAP |

||||||||||

|

Net income (loss) attributable to Stagwell Inc. common shareholders |

$ (4,247) |

$ 38,415 |

$ 34,168 |

|||||||||

|

Net income attributable to Class C shareholders |

— |

47,382 |

47,382 |

|||||||||

|

Net income (loss) attributable to Stagwell Inc. and Class C shareholders and adjusted net income |

$ (4,247) |

$ 85,797 |

$ 81,550 |

|||||||||

|

Weighted average number of common shares outstanding |

113,059 |

4,760 |

117,819 |

|||||||||

|

Weighted average number of shares of Class C Common Stock outstanding |

— |

151,649 |

151,649 |

|||||||||

|

Weighted average number of shares outstanding |

113,059 |

156,409 |

269,468 |

|||||||||

|

Diluted EPS and Adjusted Diluted EPS (1) |

$ (0.04) |

$ 0.30 |

||||||||||

|

Adjustments to Net income (loss) |

||||||||||||

|

Amortization |

$ 63,211 |

|||||||||||

|

Impairment and other losses |

1,715 |

|||||||||||

|

Stock-based compensation |

21,991 |

|||||||||||

|

Deferred acquisition consideration |

7,390 |

|||||||||||

|

Other items, net |

20,725 |

|||||||||||

|

115,032 |

||||||||||||

|

Adjusted tax expense |

(25,653) |

|||||||||||

|

89,379 |

||||||||||||

|

Net loss attributable to Class C shareholders |

(3,582) |

|||||||||||

|

$ 85,797 |

||||||||||||

|

Allocation of adjustments to Net income |

||||||||||||

|

Net income attributable to Stagwell Inc. common shareholders |

$ 38,415 |

|||||||||||

|

Net income attributable to Class C shareholders – add-backs |

50,964 |

|||||||||||

|

Net loss attributable to Class C shareholders |

(3,582) |

|||||||||||

|

47,382 |

||||||||||||

|

$ 85,797 |

||||||||||||

|

(1) |

See Non-GAAP Financial Measures section above for the definition of Adjusted Diluted EPS. |

|

SCHEDULE 12 |

||||||

|

STAGWELL INC. |

||||||

|

UNAUDITED CONSOLIDATED BALANCE SHEETS |

||||||

|

(amounts in thousands) |

||||||

|

June 30, 2025 |

December 31, 2024 |

|||||

|

ASSETS |

||||||

|

Current Assets |

||||||

|

Cash and cash equivalents |

$ 181,309 |

$ 131,339 |

||||

|

Accounts receivable, net |

769,291 |

716,415 |

||||

|

Expenditures billable to clients |

150,234 |

173,194 |

||||

|

Other current assets |

162,233 |

114,200 |

||||

|

Total Current Assets |

1,263,067 |

1,135,148 |

||||

|

Fixed assets, net |

65,267 |

72,706 |

||||

|

Right-of-use assets – operating leases |

219,717 |

219,400 |

||||

|

Goodwill |

1,600,714 |

1,554,146 |

||||

|

Other intangible assets, net |

866,780 |

836,783 |

||||

|

Deferred tax assets |

251,622 |

46,926 |

||||

|

Other assets |

50,008 |

43,112 |

||||

|

Total Assets |

$ 4,317,175 |

$ 3,908,221 |

||||

|

LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS (“RNCI”), AND SHAREHOLDERS’ EQUITY |

||||||

|

Current Liabilities |

||||||

|

Accounts payable |

$ 484,069 |

$ 449,347 |

||||

|

Accrued media |

222,472 |

245,883 |

||||

|

Accruals and other liabilities |

319,724 |

265,356 |

||||

|

Advance billings |

339,623 |

294,609 |

||||

|

Current portion of lease liabilities – operating leases |

57,192 |

60,195 |

||||

|

Current portion of deferred acquisition consideration |

41,391 |

51,906 |

||||

|

Total Current Liabilities |

1,464,471 |

1,367,296 |

||||

|

Long-term debt |

1,464,242 |

1,353,624 |

||||

|

Long-term portion of deferred acquisition consideration |

50,272 |

50,209 |

||||

|

Long-term lease liabilities – operating leases |

231,152 |

245,397 |

||||

|

Deferred tax liabilities |

49,388 |

47,239 |

||||

|

Long-term tax receivable agreement (“TRA”) liability |

223,445 |

25,493 |

||||

|

Other liabilities |

53,009 |

33,646 |

||||

|

Total Liabilities |

3,535,979 |

3,122,904 |

||||

|

Redeemable Noncontrolling Interests |

9,248 |

8,412 |

||||

|

Commitments, Contingencies and Guarantees |

||||||

|

Shareholders’ Equity |

||||||

|

Common shares – Class A |

261 |

115 |

||||

|

Common shares – Class C |

— |

2 |

||||

|

Paid-in capital |

765,898 |

343,647 |

||||

|

Retained earnings |

4,923 |

11,740 |

||||

|

Accumulated other comprehensive loss |

(20,936) |

(23,773) |

||||

|

Stagwell Inc. Shareholders’ Equity |

750,146 |

331,731 |

||||

|

Noncontrolling interests |

21,802 |

445,174 |

||||

|

Total Shareholders’ Equity |

771,948 |

776,905 |

||||

|

Total Liabilities, Redeemable Noncontrolling Interests and Shareholders’ Equity |

$ 4,317,175 |

$ 3,908,221 |

||||

|

SCHEDULE 13 |

||||||

|

STAGWELL INC. |

||||||

|

UNAUDITED SUMMARY CASH FLOW DATA |

||||||

|

(amounts in thousands) |

||||||

|

Six Months Ended June 30, |

||||||

|

2025 |

2024 |

|||||

|

Cash flows from operating activities: |

||||||

|

Net loss |

$ (9,959) |

$ (4,667) |

||||

|

Adjustments to reconcile net income to cash provided by (used in) operating activities: |

||||||

|

Stock-based compensation |

31,497 |

21,991 |

||||

|

Depreciation and amortization |

83,375 |

76,837 |

||||

|

Amortization of right-of-use lease assets and lease liability interest |

34,075 |

39,534 |

||||

|

Impairment and other (gains) losses |

(3,529) |

1,715 |

||||

|

Deferred income taxes |

(1,424) |

3,797 |

||||

|

Adjustment to deferred acquisition consideration |

3,437 |

7,390 |

||||

|

Other, net |

(7,517) |

3,850 |

||||

|

Changes in working capital: |

||||||

|

Accounts receivable |

7,941 |

(30,157) |

||||

|

Expenditures billable to clients |

27,021 |

(6,516) |

||||

|

Other assets |

(41,375) |

(5,776) |

||||

|

Accounts payable |

25,333 |

(28,576) |

||||

|

Accrued expenses and other liabilities |

(89,393) |

(114,353) |

||||

|

Advance billings |

35,765 |

12,092 |

||||

|

Current portion of lease liabilities – operating leases |

(40,509) |

(41,924) |

||||

|

Deferred acquisition related payments |

— |

(2,855) |

||||

|

Net cash provided by (used in) operating activities |

54,738 |

(67,618) |

||||

|

Cash flows from investing activities: |

||||||

|

Capitalized software |

(29,241) |

(17,076) |

||||

|

Capital expenditures |

(11,595) |

(13,990) |

||||

|

Acquisitions, net of cash acquired |

14,172 |

(20,350) |

||||

|

Other |

(8,272) |

(767) |

||||

|

Net cash used in investing activities |

(34,936) |

(52,183) |

||||

|

Cash flows from financing activities: |

||||||

|

Repayment of borrowings under revolving credit facility |

(925,000) |

(761,000) |

||||

|

Proceeds from borrowings under revolving credit facility |

1,038,000 |

1,036,000 |

||||

|

Shares repurchased and cancelled |

(67,504) |

(86,934) |

||||

|

Distributions to noncontrolling interests |

(4,761) |

(22,483) |

||||

|

Payment of deferred consideration |

(16,103) |

(23,963) |

||||

|

Purchase of noncontrolling interest |

— |

(3,316) |

||||

|

Debt financing and other costs |

(3,570) |

— |

||||

|

Net cash provided by financing activities |

21,062 |

138,304 |

||||

|

Effect of exchange rate changes on cash and cash equivalents |

9,106 |

(2,162) |

||||

|

Net increase in cash and cash equivalents |

49,970 |

16,341 |

||||

|

Cash and cash equivalents at beginning of period |

131,339 |

119,737 |

||||

|

Cash and cash equivalents at end of period |

$ 181,309 |

$ 136,078 |

||||

SOURCE Stagwell Inc.

WANT YOUR COMPANY’S NEWS FEATURED ON PRNEWSWIRE.COM?

![]()

440k+

Newsrooms &

Influencers

![]()

9k+

Digital Media

Outlets

![]()

270k+

Journalists

Opted In