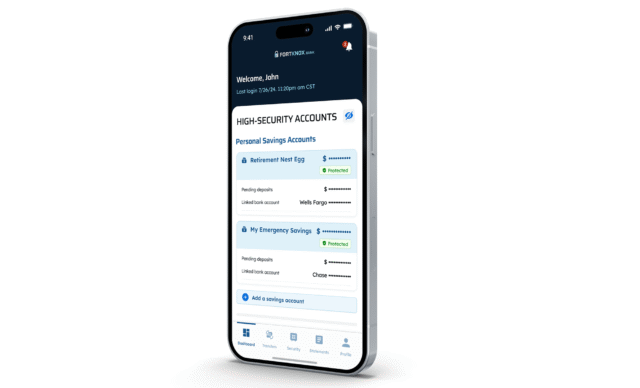

A new kind of savings account built to stop fraud before it starts is now available nationwide. Fort Knox Bank’s High-Security Savings Account, developed by Austin Capital Bank, removes passwords entirely and uses biometric identity verification with proprietary Closed-Loop technology to keep criminals out.

The launch comes at a time when U.S. consumers are facing unprecedented levels of financial crime. According to the Federal Trade Commission, losses from fraud hit $12.5 billion in 2024, a 25 percent leap from the year before.

Nearly one in three Americans fell victim to scams in the past year alone, and FTC projections suggest losses could climb to $40 billion by 2027 as AI-driven schemes continue to evolve.

SEE ALSO: 97 percent of banks hit by third-party data breaches

“It doesn’t matter how convenient your banking is if your money isn’t safe — criminals love easy access and fast transfers too,” said Erik Beguin, CEO and founder of Austin Capital Bank. “Today, we’re introducing an entirely new category of bank accounts: the high-security savings account. While traditional banks and payment providers try to balance convenience with security, and achieve neither, the Fort Knox HSSA fundamentally reimagines how banks protect customer assets with a platform and architecture built to prioritize security at every level.”

Unlike traditional accounts that display routing and account numbers, the Fort Knox High-Security Savings Account hides this information entirely.

Funds can only move between the Fort Knox account and one external account that the customer has securely linked in advance. No other transfers are possible, which means a fraudster cannot redirect funds to a new or unknown destination.

“Nearly every American will be targeted by multiple fraud attempts today — and every day going forward. The criminals are getting faster, smarter and more relentless,” said Beguin. “The hard truth is that if you haven’t been a victim of bank fraud yourself, you know someone who has. The traditional security model — a username, a password and a one-time code — just isn’t enough anymore. Criminals have evolved. Banks haven’t. We created Fort Knox so Americans can sleep well at night knowing their life savings are protected — and that their money will be there when they need it.”

Advanced security

Security features extend beyond the Closed-Loop system. Customers can trigger Lockdown mode at any time, freezing all incoming and outgoing transfers until they choose to restore access. Withdrawals are deliberately delayed by two business days, giving users a chance to verify any activity before funds leave the account.

In addition to CLEAR-powered identity checks and biometric login, the platform blacklists high-risk financial institutions and apps. It also uses custom account identifiers that cannot be used with standard payment networks, making unauthorized withdrawals even less likely.

The account is FDIC-insured through Austin Capital Bank and offers a competitive interest rate while maintaining strict control over access. The bank positions it as a product for those who want certainty that their money will remain untouched without their consent.

Fort Knox High-Security Savings Accounts are now open to customers across the United States at www.FortKnox.Bank.

What do you think about Fort Knox’s approach to banking security? Let us know in the comments.

![navigating-nis-2-compliance-[q&a]](https://thetechbriefs.com/wp-content/uploads/2025/02/6546-navigating-nis-2-compliance-qa.jpg)